Batteries could, at least in theory, prove to become the industry panacea that delivers true zero-emissions flight.

They already did the trick for cars. In less than two decades, starting from rather lackluster performances, electric cars have managed to outcompete their fossil-fuel-powered equivalents in several markets.

But lifting an aircraft off the ground and getting it to fly fast and far is a challenge of a rather different magnitude. If you are looking for a Tesla-like version of your typical mid-sized airliner, you’d better be patient.

The energy density provided by present day battery technology makes anything other than small, short range electric planes nothing more than a pipe dream.

However, as is usually the case with emerging industries, there is hope that a combination of scientific advances and industrial learning curves will keep pushing the technological frontier further and further onwards. This has, after all, been the story of so many other advanced tech industries, from microchips to electric cars.

Is the battery industry in a position to deliver on these expectations, then?

Which are the most experimental battery chemistries currently being developed for the aviation market?

Are there any real prospects of batteries powering anything other than light, short-range aircraft and the new crop of yet-unproven urban air mobility vehicles?

AeroTime has posed these questions to some of the world’s leading battery experts, as well as to several prominent industry players. Keep reading for a realistic, qualified assessment of where the aviation battery industry stands in 2024, and its most immediate prospects.

The chemistry dilemma

If we look at batteries from the perspective of chemistry, one of the first things that becomes apparent is that the performance of the current generation of Lithium-Ion batteries, which have been instrumental in accelerating the electric car revolution, is insufficient to power the nascent electric aviation industry.

This doesn’t mean that Lithium-Ion chemistry has reached the end of the road. A promising new way to boost its performance is to replace the graphite anodes with silicon ones.

This is the approach that’s been adopted by a number of players in the aviation industry, such as Lilium. In April 2024, the German eVTOL developer announced that it had started to assemble battery packs made of Lithium-Ion cells fitted with silicon anodes.

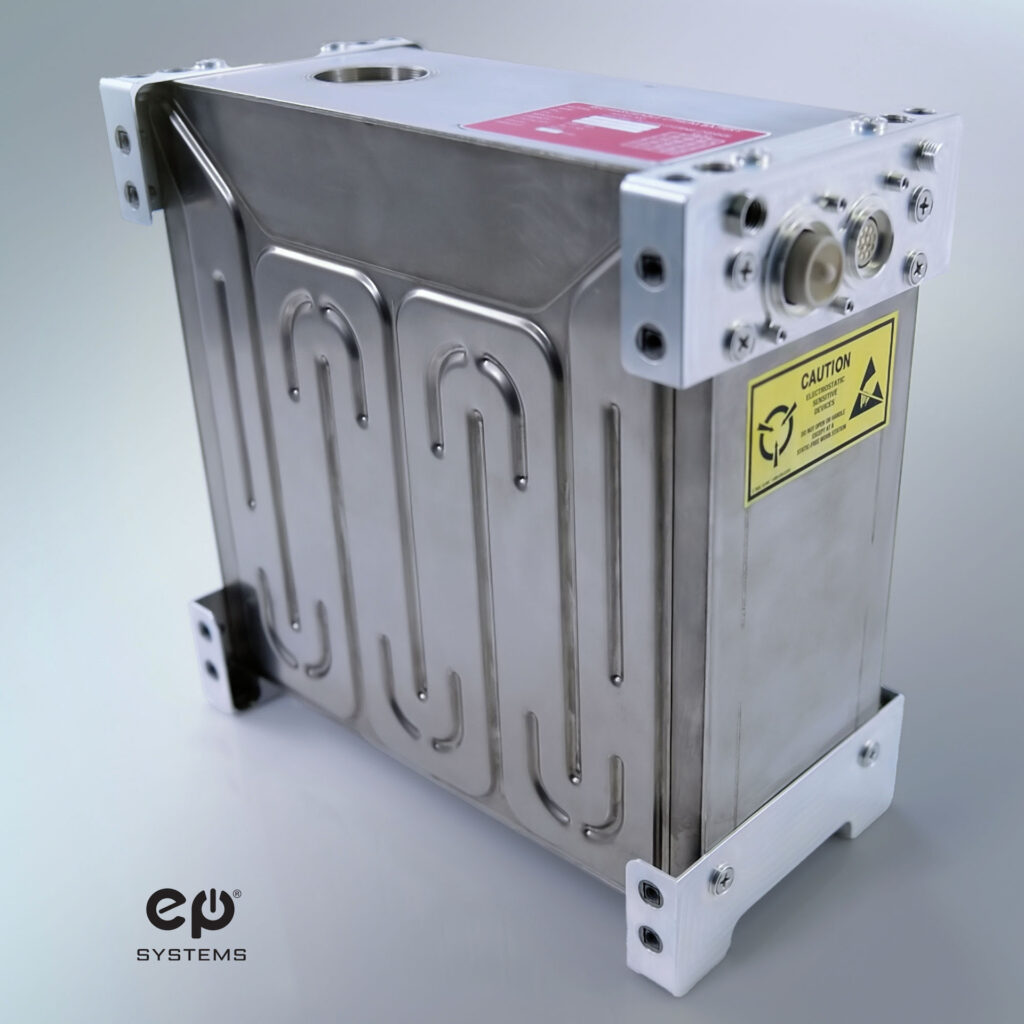

In the same month, another firm betting on silicon anode technology, Electric Power Systems (EPS), presented the EPiC 2.0. battery system, which has been conceived specifically with the needs of the aviation market in mind.

This Utah-based startup, which has JetBlue Technology Ventures among its investors, has used silicon anode technology to boost the performance of an earlier battery system and achieve an energy density of up to 330 Wh/kg at cell level and 265 Wh/kg at pack level.

(At this point, it is important to note that, when talking about the energy density of a battery, figures are sometimes given at cell level and at other times at pack level, with the latter being typically 20-30% lower.)

If equipped with the new EPiC 2.0 system, a light two-seater electric aircraft could see its potential flying time increased by 30 minutes, from 60 to 90 minutes.

This incremental improvement may not sound like much, but it will likely be sufficient to meet the energy reserve requirements that the Federal Aviation Administration (FAA) sets for Part 23 aircraft, which encompasses general aviation and training aircraft.

Michael Duffy, VP Product Development at EPS, explained to AeroTime that there are at present no FAA-certified batteries available for this category of aircraft [the only serially produced certified electric aircraft as of June 2024 is the Pipistrel Velis Electro, which received its certification from the European authority, EASA – Note. Ed].

EPS is looking to target the flight school market with the EPiC 2.0., which it expects to be market-ready by 2025.

According to battery expert Richard Wang, realistically high-power batteries with silicon anodes can reach up to around 350 Wh/kg, while Lithium-Metal, another promising technology that is currently under development, could get to the region of 450 Wh/kg.

In 2015, Wang founded Cuberg as a spin-off from Stanford University, in order to develop Lithium-Metal batteries for the aerospace industry. In 2021, Swedish battery giant Northvolt acquired California-based Cuberg for an undisclosed amount, with the aim of turning it into an aviation-focused arm of Northvolt.

Wang left Cuberg in February 2024 and went on to found Crevasse Consulting, a firm advising electric vehicle developers on battery-related matters. He considers silicon anodes and lithium-metal batteries as the two technologies that have the greatest potential to make it to the industrial stage over the next few years.

In conversation with AeroTime, the battery entrepreneur and consultant highlighted that there are significant differences between the two technologies. He suggested that there are some trade-offs to be considered as well: silicon anode batteries may be better at fast charging, while lithium-metal is better at fast discharging over many cycles.

He also pointed out that the silicon-anode technology may have a slight developmental advantage and will probably enter service around 2025/26, whereas lithium-metal batteries are not likely to enter service until 2027/28.

In addition to the different chemistry approaches, battery developers are experimenting with other aspects, such as the battery pack architecture and the shape of the cells – that is, the basic units of which the batteries are composed.

Cylindrical vs Pouch Cells

Many companies use cylindrical cells in their batteries, including Tesla and eVTOL developers such as Archer or Vertical Aerospace. However, pouch cells, which are roughly rectangular and flat, have been gaining favor with several advanced battery developers. The latter include the aforementioned Cuberg, as well as Bold, a Barcelona-based startup which has developed a 285 Wh/kg battery pack called Bold Air, designed for aerospace applications.

Joby Aviation, one of the leading players in the eVTOL scene, has also opted to use lithium-ion pouch cells for its pack.

“Cylindrical cells are easier to assemble in a pack,” Wang explained. “However, their performance realistically peaks at around 270 Wh/kg with graphite-dominant anodes, and they struggle to integrate advanced next-gen chemistries such as silicon-dominant or lithium metal anodes.” He added that “pouch cells have more energy density upside and are easier to make as individual cells, but notably they’re more difficult to assemble as a pack. This is due mainly to them being less predictable when it comes to their profile of thermal runaway, and specifically, the manner and direction in which they vent hot gases and solids.”

Wang was referring to the risk that, when stacked closely together, the battery cells may overheat and catch fire, whether due to manufacturing defects or misuse during operation.

Venkat Viswanathan, a leading battery researcher at the University of Michigan consulted by AeroTime, added another dimension to the heat management issue.

“Most of the heating happens during charging,” Viswanathan explained. “This is why Joby Aviation has developed a charger that integrates a cooling system. This helps manage the heat buildup during charging, so the aircraft operator only needs to focus on the heating that takes place during flight operations, a much less demanding proposition. Whomever wins the charger standards battle is going to affect how people think about battery packs.”

An industry in flux

The manufacture of the battery cells, and their assembly into a pack, is often undertaken by separate companies. Electric Power Systems (EPS), for example, works with different cell manufacturers building the battery cells to their specifications, before EPS assembles them.

EPS’ Michael Duffy explained to AeroTime that the company sits between the original equipment manufacturers (OEMs) on one side and the cell manufacturers on the other, thereby retaining the flexibility to pick the best solutions to meet the OEM’s specifications.

EPS considers its battery chemistry-agnosticism to be a plus, since it doesn’t tie the company to a specific chemistry. Some other cell manufacturers hold the opposite view and consider that they are best placed to optimize the stacking of their own cells. This has prompted some cell manufacturers to try to move up the value chain and become pack integrators as well

This change in the dynamics of the industry could also be due to the fact that, as electric aviation has matured, it has become more vertically integrated. This is something that has happened earlier in other industries, such as automotive.

It is not enough to simply make things work on paper, though.

The industrial challenges in battery making are considerable. It’s fine to get the latest battery chemistries to work in a lab, but producing at scale is a much tougher challenge than it sounds, both operationally and financially, as confirmed by several of the major industry players interviewed by AeroTime.

“You need a lot of money to get to production stage. You also need a validation campaign,” explained Venkat Viswanathan, a researcher at the University of Michigan considered to be one of the world’s top battery experts.

“You need to produce 10 to 20 times more battery cells than at prototype stage. If at industrial production $100/kWh is feasible, at small volume levels $10,000/kWh, so a validation campaign at 1 MWh, would cost around $10M, and at the moment funding for batteries has pretty much dried up.” he added.

These figures were also confirmed by Wang, who pointed to another possible reason why battery development isn’t moving as fast as was originally predicted.

“The eVTOL and battery SPACs have not gone as expected and people are reluctant to invest, although there are many opportunities,” he explained.

There are other potential battery chemistries. One such is Lithium-Sulphur, which, while promising, has remained mostly confined to academic research so far. Another is Aluminum, a path pursued by Wright Electric, an aerospace startup that cooperates with NASA and a number of research institutions and aviation firms.

The US Department of Energy has also been investing in a research program that aims to get to 1000 Wh/kg.

However, all of the experts consulted for this article agree that these technologies are considerably less mature, and that, even in a best-case scenario, it may take at least a decade to get to the point at which commercial applications become a real possibility.