Anyone trying to stay on top of commercial aviation growth at present is likely to be keeping their eyes firmly focused on the Asia- Pacific region. With two of the world’s biggest aircraft manufacturers foreseeing major growth in passenger air traffic and commercial aircraft services in this part of the world over the next 20 years, it’s clear that the region is a fast-growing hotspot for the aviation industry.

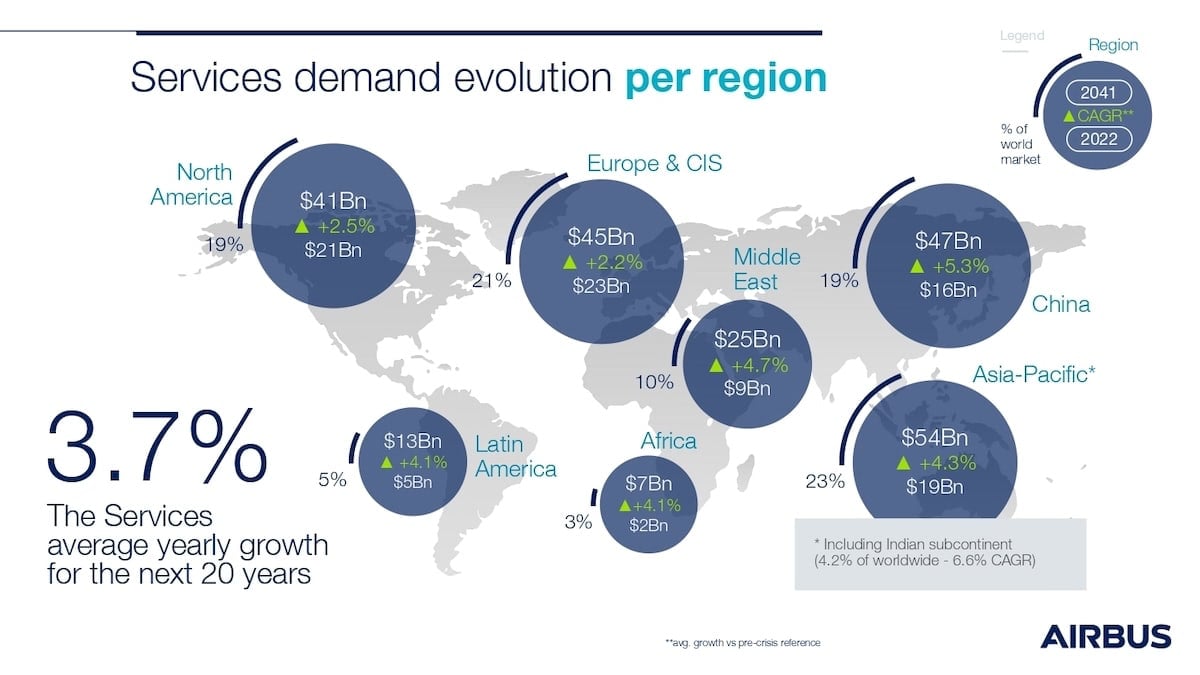

As part of its 2023-2043 Global Services Forecast, Airbus asserted that the commercial aircraft services market in the Asia-Pacific region will more than double in value from US$52 billion today to US$129 billion by 2043.

The European aircraft manufacturer declared that, for Asia Pacific alone, it anticipates a need for 999,000 new skilled professionals (nearly 45% of global manpower) over the next 20 years, comprising 268,000 new pilots, 298,000 new technicians and 433,000 new cabin crew members.

Airbus Senior Vice President Customer Services Cristina Aguilar Grieder said: “The Asia-Pacific region will see the largest volume of growth and activity in terms of aftermarket services, with many opportunities for additional efficiency, simplification and responsible operations.”

In its 2024 Commercial Market Outlook report on the region, Boeing predicted that air traffic in Southeast Asia will more than triple through 2043.

Boeing reckons that the region’s airplane fleet is also projected to more than triple to 4,960 jets in order to meet the rising air travel demand. According to its commercial market outlook, passenger air traffic in Southeast Asia will grow 7.2% annually through 2043 – well above the 4.7% average annual growth rate globally.

The American aircraft manufacturer’s 20-year forecast also included the following predictions:

- Southeast Asia operators will need to hire and train 234,000 new pilots, maintenance technicians and cabin crew – more than tripling the region’s active personnel.

- Airlines in Southeast Asia will expand their share of the Asia-Pacific fleet from 17% to 25%.

- To meet long-haul demand, widebodies like the 787 Dreamliner will make up one in five deliveries in Southeast Asia.

- The region will need more than 120 new and converted freighters to support increasingly diversified global supply chains, as well as growing e-commerce demand.

What’s driving aviation growth in Southeast Asia?

The ASEAN (Association of Southeast Asian Nations) member countries are Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand and Vietnam.

With a combined economic output of close to USD three trillion in 2020, ASEAN Member States are spread across three levels of economic development, based on the World Bank country income classification:

The two countries considered as high-income economies are Singapore and Brunei Darussalam. Malaysia and Thailand have upper-middle level income economies, and Indonesia, the Philippines, Vietnam, Lao PDR, Cambodia and Myanmar are considered lower-middle income economies.

With a population of 685 million (according to the April 2024 World Economic Outlook by IMF), the economic upsurge in Southeast Asia is driven by its people. Boeing attributes Southeast Asia’s aviation growth to a rising middle class and above-global-average economic growth.

“With Southeast Asia’s economy forecast to have the second-highest growth rate among global regions, rising household incomes will bring new consumers into this aviation market, fueling growth for low cost and leisure business models,” David Schulte, Managing Director of Boeing Commercial Marketing for Northeast Asia, Southeast Asia and Oceania said in the commercial outlook report.

In a September 2024 report, strategic foresight company Futures Platform noted that Asia’s middle class is growing at a much faster rate than comparable Western countries, and that the consumption balance is shifting toward the emerging markets in Asia.

The rising middle class’ effect on economic growth in Southeast Asia was documented by a 2017 World Bank report, noting that the rise of population in the region obtaining secondary and tertiary education has been a key factor driving a rise in the income share held by the middle class.

At the February 2024 Routes Asia development forum in Langkawi, Malaysia, Airports Council International (ACI) Asia-Pacific and Middle East Director General Stefano Baronci said that Indonesia is expected to rise up the ranks of the world’s busiest passenger markets to take seventh place in 2032, reaching fourth by 2042.

Baronci also said that the Philippines, India, Indonesia and Thailand will top the fastest-growing markets between 2023-42, with compound annual growth rate (CAGR) between 6.2%-7.2%.

Vietnam and the Philippines driving plane orders in Southeast Asia

Boeing said that it foresees Southeast Asia’s growing fleet – especially single-aisle airplanes – playing an important role in connecting the region’s island geography and serving travel demand across the Asia-Pacific region.

In September 2024, Brazilian aircraft manufacturer Embraer announced that it had signed agreements with two MRO (maintenance, Repair, and Overhaul) providers in the Asia-Pacific region (Clark, Philippines, and Singapore). They will offer authorized service centers for the Embraer E-Jet and E2 series of regional jets.

Singaporean low-cost carrier Scoot, a subsidiary of Singapore Airlines, has a firm order for nine E190-E2 jets, two of which are already in service with the carrier. Scoot became the first E-Jet E2 operator in Southeast Asia when its first aircraft was delivered in April 2024 and it has two more due for delivery by the end of 2024.

For 2024, major aircraft orders in the Southeast Asian region are dominated by two countries expected to have the highest gross domestic product (GDP) growth rate in the 2024-2034 period, namely Vietnam and the Philippines.

At the February 2024 Singapore Airshow, Vietnamese low-cost carrier Vietjet signed a Memorandum of Understanding (MoU) with Airbus for the purchase of 20 A330neo, its first-ever widebody order.

The aircraft will be operated on the carrier’s growing long-range network, as well as on high capacity regional services, and is set to replace Vietjet’s current fleet of leased A330-300.

During the ceremony, attended by AeroTime, Vietjet Chief Executive Officer Dinh Viet Phuong said: “The new A330neo aircraft is a strategic addition to comprehensively modernize Vietjet’s fleet, enhancing operational capabilities to support our global flight network expansion plan. Its fuel-efficient new-generation design aligns with our sustainable development strategy and ESG goals, aiming for net-zero emissions by 2050.”

At the Farnborough Airshow in July 2024, Airbus and Vietjet sealed the deal for a $7.4 billion agreement for the order of 20 A330-900 jets.

The order forms part of a larger MoU signed in 2013 by Vietjet in Montignon Castle, Paris for an order of 100 Airbus aircraft of different types. Airbus’ 2013 price list valued the order at US$9.1 billion.

In 2019, the low-cost carrier became the first airline in the world to operate the A321neo ACF (Airbus Cabin Flex).

At the Vietnam-Ireland bilateral talks in Dublin on October 1-3, 2024, Vietjet and Irish aircraft leasing company Castlelake signed an MoU to finance four Airbus A321neo aircraft valued at US$560 million.

As part of the MoU, Castlelake will provide financing for four new Airbus A321neo aircraft, under Vietjet’s existing order with Airbus.

“The agreement signed today aligns with Vietjet’s strategy to expand its fleet and global flight network. Backed by international financing, Vietjet continues to provide safe, comfortable, and cost-effective flights on new, modern aircraft, connecting travelers to exciting global destinations,” CEO Phuong said.

Meanwhile, in the Philippines, another low-cost carrier broke aviation history records for the country with its aircraft order.

In July 2024, Cebu Pacific announced that it would buy up to 152 Airbus planes, worth PHP 1.4 trillion ($24 billion), in a deal described as the largest aircraft order in the country’s aviation history.

The Cebu-based airline’s agreement with Airbus includes firm orders for 102 A321neo aircraft, along with purchase rights for an additional 50 A320neo family aircraft.

In the first six months of 2024, Cebu Pacific Air’s operating profits surged by 44%, reaching PHP 5. 5 billion ($96 million). This growth was underpinned by a 16% rise in revenues, which totaled PHP 51. 4 billion for the period ending June 30, 2024.

An MoU was signed by Airbus, Cebu Pacific and RTX’s Pratt & Whitney at the Farnborough Airshow in July 2024.

“The order is designed to give Cebu Pacific the flexibility to choose between the A321neo and A320neo aircraft as needed, helping us adapt to market changes,” Michael Szucs, Chief Executive Officer of Cebu Pacific, said in a statement.

“This deal is a significant milestone in our ongoing mission to make air travel more accessible and affordable for everyone while supporting the Philippine growth story,” Szucs added.

The deal was made official during a signing ceremony in Manila on October 2, 2024, by Szücs and Benoît de Saint-Exupéry, EVP Sales of Commercial Aircraft business at Airbus.

“This milestone signals our ongoing dedication to expanding air travel accessibility and affordability, while supporting the Philippine’s broader economic growth and connectivity goals,” Szücs said during the ceremony, which was attended by AeroTime.

What does aviation growth actually mean for the Southeast Asian population?

To fully grasp the impact of aviation in Southeast Asia, it’s important to get a sense of its geography. Not only are the countries separated, some of the countries are also archipelagos, meaning that the countries themselves are made up of a multitude of different islands.

Before commercial aviation became accessible to the general population, people in Southeast Asia traveled by bus and ferry, which not only took days but could also often be perilous.

Commercial and passenger ship transport is more common in Indonesia and the Philippines, as both countries are archipelagos. As such, maritime accident rates are also high in both the Philippines and Indonesia.

The two maritime accidents with the most number of casualties worldwide occurred in these countries.

In January 1981, Tampomas II, an Indonesian Roll-on-roll-off (Roro) and passenger ferry carrying 1,054 passengers, 82 crew members and 200 cars onboard sank in the Java Sea after a fire and explosion occurred in the ferry’s engine room. It claimed the lives of over 600 people, making it the deadliest maritime accident in Indonesian history.

On December 20, 1987, MV Dona Paz, a Japanese-built and Philippine-registered passenger ferry set off from Tacloban, Leyte Island, to Manila, the capital of the Philippines. Six hours before reaching the port of Manila, an oil tanker, MT Vector, carrying over 1,000 tons of gasoline and petroleum products collided with the MV Dona Paz in the middle of the night.

The fiery disaster had an estimated death toll of 4,385 people and left only 26 survivors. To this day, it remains the deadliest maritime accident in the world.

A survey conducted by data gathering company Statista showed that, between 2017 and 2022, ship accidents in Indonesia have decreased since 2017. In the Philippines, a report made by the Philippine Marine Environment Protection showed that maritime accidents in the country in the year 2022 had decreased 54% as compared to the previous year.

Though there is no direct correlational study proving that commercial aviation played a role in decreasing maritime disasters, it certainly offers a safer option for people to travel across islands.

The importance of regional air connectivity in Southeast Asia

In October 2024, Franco-Italian aircraft manufacturer ATR released a series of videos showcasing the impact of regional air connectivity on local communities and industries across Indonesia.

Indonesia is made up of 17,000 islands and spans 5,120 kilometers from east to west, stretching further than the continental United States. Therefore, air travel is a necessity for the mobility of both people and goods.

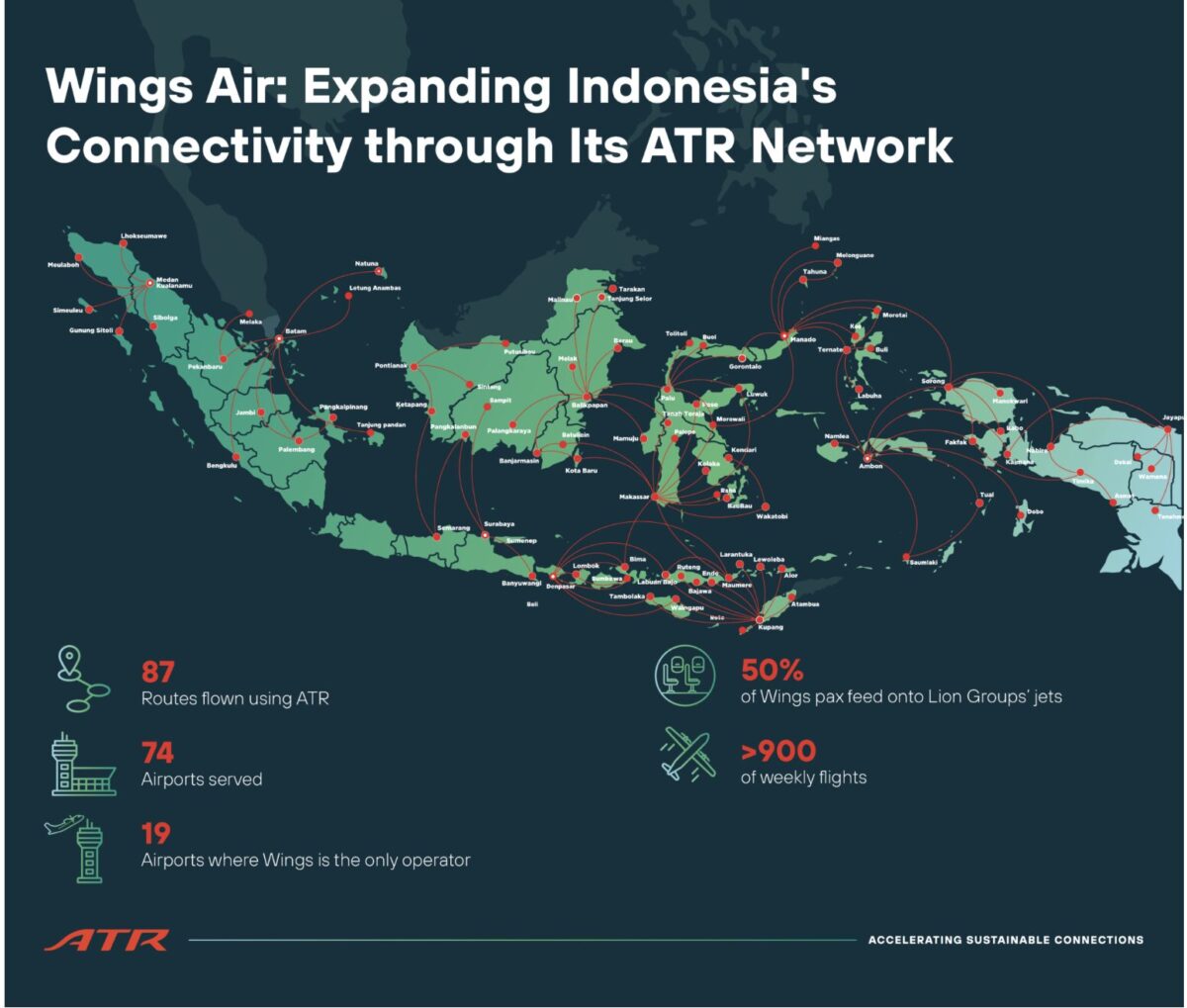

One of the videos produced by ATR is about Wings Air, a scheduled commuter passenger low-cost airline based in Jakarta. With a fleet of more than 70 aircraft, the airline has helped make regional air travel accessible to Indonesians. The carrier is also currently the world’s largest ATR operator.

Another video made by ATR demonstrates how improved air connectivity has enabled local mountain coffee growers from the island of Flores to reach wider markets.

The terrain of Flores is rugged, pockmarked with numerous active and inactive volcanoes. Ashes from these volcanoes produced fertile andosols which are ideal for organic coffee production. Arabica Coffee is grown at 1,200 to 1,800 meters on the hillsides and plateaus of Flores.

With connectivity enhanced by ATR, farmers can attract more buyers and command higher prices for their beans, which in turn strengthens the local economy and improves the populations’ livelihoods.

In a statement, ATR said: “Through the efforts of companies like Wings Air and ATR, air connectivity is transforming lives, economies, and ecosystems across Indonesia. The nation’s archipelagic nature no longer represents a barrier but an opportunity — an opportunity to explore, engage, and empower. As these communities grow closer through the power of flight, the future of Indonesia’s islands has never looked brighter.”

In the Philippines, low-cost carrier Cebu Pacific offers not just a quicker option to get around domestically, but also a more affordable option for overseas migrant workers who wish to travel home more frequently.

A 2023 data by the Philippine Statistics Authority show that there are an estimated 2.16 million Filipino overseas migrant workers. Almost 50% of this population of migrant workers live in the Middle East. Long before low-cost carriers served the Middle East-Asia route, overseas migrant workers, especially those with blue collar jobs, often took years saving for airfares to visit their families back home in the Philippines.

In October 2013, Cebu Pacific, whose motto is to ‘fly every Juan’ (Juan dela Cruz being the national personification of the common man in the Philippines), became the first budget carrier to launch flights between Dubai International Airport (DXB) to Manila International Airport (MNL).

The airline launched the flights alongside a giveaway contest for overseas workers. Among the hopeful migrant workers was a waiter at a Dubai restaurant who had been skipping meals to save up for a $1,000 return ticket to the Philippines. When Cebu Pacific launched its Dubai-Manila flights, it started out with an introductory fare of $103.00 for a one-way ticket.

A video campaign released by Cebu Pacific in 2023 shows one Dubai-based overseas Filipino worker explaining how the airline’s regular seat sale has helped her in securing affordable fares to visit home and be with her family.

For developing countries like the Philippines and Indonesia, accessibility in aviation goes beyond tourism or reaching exotic island destinations. Having access to travel options and affordable fares can actually save lives and sustain livelihoods.

Initiatives for Sustainable Aviation Fuel (SAF) in Southeast Asia

Compared to Europe and North America, initiatives for SAF have lagged in Southeast Asia. Limited sustainable aviation fuel production facilities and lack of government mandates are among the key factors here.

However, things are underway for the production of SAF in Southeast Asia to kick in during 2024.

At the Singapore Airshow in February 2024, Airbus, along with the Singapore Economic Development Board (EDB) signed an MoU to facilitate the establishment of a Sustainable Aviation Hub, with a specific focus on technology, research and innovation.

The Hub is intended to bring together aerospace professionals, researchers and innovators, to create a collaborative environment that can promote research and development aimed at building a robust and environmentally sustainable aviation ecosystem.

On September 20, 2024, Airbus and AirAsia entered into an MoU to explore decentralized production of SAF using alternative feedstock and technologies in Southeast Asia.

Under the MoU, the two companies will jointly investigate advanced measures to improve air traffic management (ATM) to reduce CO2 emissions.

“AirAsia is a key partner in the ASEAN region and we are excited to work with the airline to explore operational efficiency levers, including air traffic management and scaling up the production and distribution of SAF,” Airbus Chief Sustainability Officer Julie Kitcher said in a statement.

At the 2024 Aviation Summit held in Manila on October 2-3, 2024, the Philippine government and Airbus announced the forming of a partnership to explore the feasibility of producing SAF in the country.

The collaborative study, which will be based on the current International Civil Aviation Organization (ICAO) ACT-SAF template, will include the analysis of macroeconomic data specific to the Philippines, evaluation of SAF feedstocks and production pathways and assessing relevant implementation support, financing and policies, as well as drafting an action plan.

An August 2024 report by the Roundtable on Sustainable Biomaterials (RSB), supported by Boeing, found that by 2050, Southeast Asia’s bio-based feedstock capacity could produce approximately 45.7 million metric tons of SAF per year, which is approximately 12% of global SAF demand.

Southeast Asia’s unique path to becoming an aviation hub

“With an expanding middle-class, in a market that continues to liberalize, coupled with a strong domestic, regional and international tourism sector, Southeast Asia has become one of the world’s largest aviation markets,” former Vice President of Commercial Marketing at Boeing Randy Tinseth said, as quoted by aviation maintenance company Magnetic Group.

In summary, Southeast Asia is a current, live case study of a region that is fast developing to become an aviation hub. What makes its growth unique is that it is not propelled by megacities, major carriers or jumbo jets. but mostly through budget carriers, narrowbody planes and secondary cities.

The rapid development of Southeast Asian aviation proves that there is power in small planes, tiny islands and ordinary people.