New York-based JetBlue Airways has announced it will terminate services to several of its domestic and international destinations in a bid to cut costs and reduce losses following the termination of its $3.8 billion merger plans with fellow US carrier Spirit Airlines in February 2024.

Under the cost-cutting plan, the carrier will swing the axe over routes from its loss-making west coast US hub located at Los Angeles International Airport (LAX) as well as from Fort Lauderdale International Airport (FLL) in Florida.

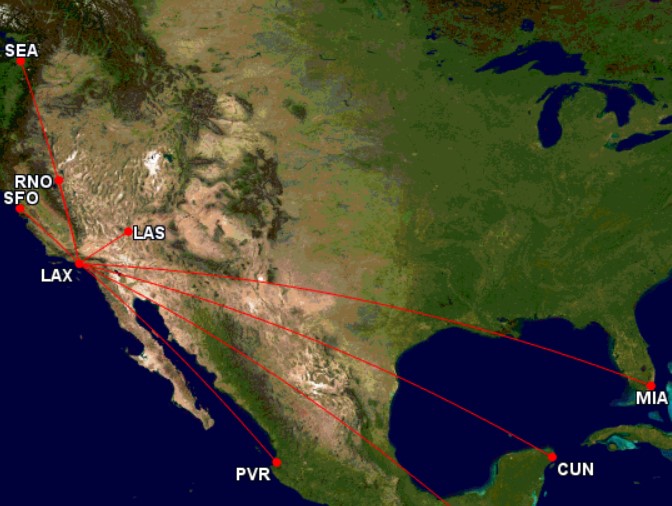

From Los Angeles, JetBlue will cut almost a third of its flights from the airport effective from June 2024. Routes to be cut include those to Miami (MIA), Las Vegas (LAS), Reno (RNO), Seattle (SEA), and San Francisco (SFO). The carrier will also drop international routes from Los Angeles to Cancun (CUN), Liberia, Costa Rica (LIR), and Puerto Vallarta (PVR). In all, the number of daily departures from the airport will drop from 34 to 24 per day.

From Fort Lauderdale, the carrier will eliminate flights to several cities including Atlanta (ATL), Austin (AUS), Nashville (BNA), New Orleans (MSY), and Salt Lake City (SLC).

In addition to the service cuts from Los Angeles and Fort Lauderdale, JetBlue says it will also completely exit the markets from Kansa City (MCI), Newburgh-Stewart (SWF), Bogotá Colombia (BOG), Quito, Ecuador (UIA), and Lima, Peru (LIM) with all services ending on June 13, 2024.

Elsewhere on the JetBlue network, services will also be dropped between Tampa (TPA) and Aguadilla (BQA), Orlando (MCO) to Salt Lake City (SLC), and New York-JFK to Detroit (DTW).

The swingeing service cuts come amid a broader strategy evaluation of the airline (including its route network and fleet size) instigated by the company’s new CEO, Joanne Geraghty. The airline had been losing both customers and money throughout 2023 – a process that has continued into 2024.

Additionally, the carrier’s abandoned merger plans with Spirit Airlines means there is more management time available to address the weaker points in the company’s business model as it battles to stem losses across its network.

Drastic cost-cutting measures

Adding to the carrier’s current woes are the ongoing issues with the Pratt & Whitney engines that power its predominantly Airbus A320 family aircraft fleet. With more stringent inspections required on many of these engines by regulators, JetBlue faces having between 12 and 15 aircraft grounded at any given time throughout 2024 as they undergo these inspections.

“With less aircraft time available and the need to improve our financial performance, more than ever, every route has to earn its right to stay in the network,” said Dave Jehn, JetBlue’s vice president of network planning and airline partnerships in a memo to staff issued on Tuesday, March 19, 2024. “It’s more important than ever that we are surgical about every route in our network,” he added, emphasizing the urgency of the situation.

The latest round of route alterations and cancellations come just a month after JetBlue said it would no longer contest a federal judge’s ruling against its proposed merger with Spirit. The deal, had it been approved, would have seen the country’s sixth and seventh largest carriers combine, thereby helping JetBlue to become more competitive against its larger rivals in the US market.

Under the terms of the merger’s “walk-away” agreement, JetBlue is compelled to pay Spirit $69 million while resolving all outstanding matters related to the deal (such as the legal appeal) at its own cost.

In January 2024, JetBlue announced to shareholders that it is expecting first quarter 2024 (1Q24) revenues to drop by somewhere between 5% and 9% overall versus the same period in 2023, while capacity for Q124 will fall by up to 6%. The carrier reported a net loss of $104 million for the last quarter of 2023, which represented a significant drop when compared to the same period in 2022 when the airline reported a profit of $24 million.