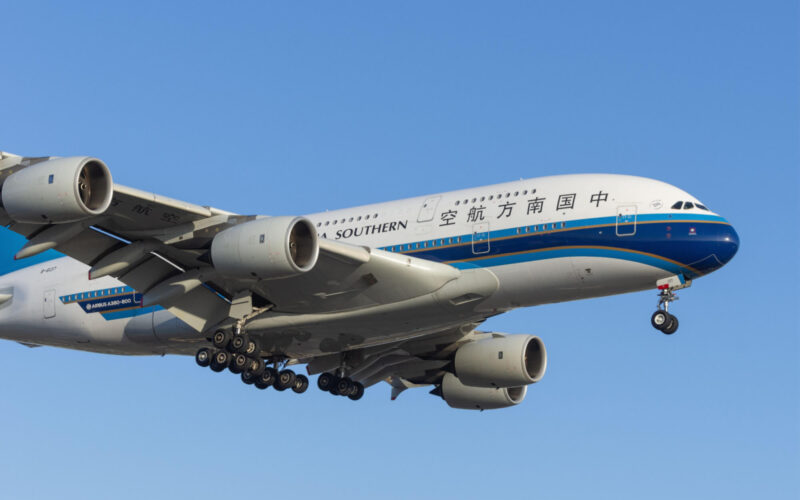

The Airbus A380 is not typically associated with carriers from Asia after becoming seemingly synonymous with Middle East-based airlines. However, China Southern Airlines (ZNH) was one of few airlines in Asia to order the type, becoming the 15th airline to do so in 2005.

The order was supposed to strengthen the position of many interested parties, including the manufacturer, carrier, and China, which was about to host the Beijing Summer Olympic Games in 2008.

However, the outlook was not necessarily rosy from the beginning. Delays mounted and the Toulouse-based Final Assembly Line (FAL) did not roll out the very first Airbus A380 on time. Delays continued to mount and instead of flying spectators prestigiously into the Beijing games with one of the newest aircraft on the market, China Southern Airlines (ZNH) had to resort to flying customers into the Chinese capital on… well, regular aircraft.

‘While this might not necessarily seem like a big deal, major sporting events and aviation, in the general sense of the word, have always gone hand in hand.

During the Olympics four years later, for examples, British Airways unveiled several special liveries on its aircraft, while Emirates, the airline synonymous with the A380, used the double-decker to fly an advertisement for the Dubai Expo across the globe.

China’s aviation potential

Was the marketing of the Games damaged by the fact that China Southern Airlines (ZNH) did not receive any A380s before the beginning of the event? Well, that’s highly debatable. But what cannot be denied is the fact that China has always been seen as the next big aviation market.

“Accessibility to air transport improved significantly over the past 20 years as has China expanded its air transport system and, in particular, its airport capacity to meet growing economic demands,” noted a report by the Organization for Economic Co-operation and Development (OECD), published in November 2008.

According to the OECD, the number of airports in the country almost doubled between 1980 and 2005 (from 77 to 142), while the number of passengers onboard aircraft grew from 3.4 million to 138.3 million in 2005. That was only the beginning, as by the end of 2019, 659.9 million passengers were recorded, according to the Civil Aviation Administration of China (CAAC). Except for 2019, the country’s traffic numbers exhibited double-digit growth Year-on-Year (YoY) throughout the 2010s.

Naturally, one of the main drivers behind the growth of the country’s aviation industry was its population. While in the early 1980s China’s economy was in its infancy, as its General Domestic Product (GDP) in 1980 was $191.1 billion, over the decades, it became a global powerhouse. In 2016, the country’s GDP was $11.2 trillion, growing to $14.2 trillion in 2019, data provided by the World Bank suggested. While the usefulness of GDP when discussing a country’s state has always been debated by economists, including the fact that it does not portray the well-being of ordinary citizens, it still is a great tool to measure the performance of an economy. At the same time, the lives of ordinary citizens have also improved during the past few decades. As of 2000, 3% of people in China were designated as middle class, while by 2018, “this number had climbed to over half of the population, constituting nearly 707 million people,” according to the Center for Strategic & International Studies (CSIS).

While China is an atypical market in which to operate, given the amount of government control, aviation giants have still eyed the country and ways to sell their products there. That includes the largest manufacturers of aircraft in the world, namely Airbus and Boeing.

Size versus efficiency

While fortunes have been mixed, the presence of western manufacturers has continued to expand in the country ever since they first entered the market in China.

Airbus, for example, first made its presence officially felt in 1994, when the European aerospace company established a training center in the country in 1994. However, it was much more than that. Airbus was attempting to compete with Boeing, who first entered the market in 1972 when it sold 10 Boeing 707 aircraft to local airlines. While both companies seemingly hoped that the fruits of their labor would blossom into something tangible, they took two completely different approaches to this.

While Boeing bet on the fuel-efficient 787 Dreamliner, Airbus’ anticipated that aviation would develop into a system where hubs would serve millions of passengers, requiring large aircraft to transport a lot of people at once. Thus, following the manufacturer’s first studies into the concept, the A3XX would eventually become the Airbus A380, making it the largest commercial aircraft to be made in size and in capacity. The size brought its fair share of complexity not only for the European planemaker but for airports as well, for example, as passengers needed to be boarded onto the second floor, which required special gate infrastructure.

Airbus was serious about its ambitions to sell the A380 in China. When China Southern Airlines (ZNH) became the first airline in the country to order the superjumbo in January 2005, Airbus’ then-president and CEO Noël Forgeard noted that it was a “significant breakthrough of our business in this important and strategic market”.

“The A380 will effectively accommodate ever-growing air travel demand in the dynamic Chinese market and will be able to provide first-class services to the 2008 Olympics in Beijing, 2010 World Expo in Shanghai, and 2010 Asian Games in Guangzhou,” Forgeard added.

The A380 finally made it to the Chinese airline in October 2011, after all three events had concluded.

“China Southern is proud to operate the largest passenger capacity, largest modern jet fleet and the most sophisticated integrated airline network with the highest safety standards of any airline in China,” a statement from the airline noted at the time.

However, apart from the five Airbus A380s operated by CSA, no other carrier signed up to purchase and fly the double-decker jet in China. The Boeing 787 sold well in the country, and the US manufacturer even agreed to assign $600 million in contracts to Chinese suppliers to build parts for its aircraft, including the Dreamliner, according to a press release issued by the company in June 2005.

“Today’s agreements, in full compliance with U.S. and Chinese export regulations, offer a continuing example of the important and growing role in China on the 787 and participation in the 777, 747 and 737 airplane programs,” said then-Boeing Commercial Airplanes Vice President and General Manager, Airplane Production Carolyn Corvi.

While Airbus managed to deliver a total of five A380s to a single Chinese airline, Boeing shipped off 97 Dreamliners with 11 unfilled orders as of October 31, 2022 to carriers based in the country.

Early struggles with the A380?

Putting aside the fact that the superjumbo was quite late to several parties in China (though the 787 was as well, with the first delivery occurring in 2013), CSA also struggled to identify markets where it could utilize the capacity provided by the double-decker.

Initially, China Southern Airlines (ZNH) passengers were only able to enjoy the A380 on domestic routes, as well as shuttles to Hong Kong, because the aircraft did not fly internationally until October 2012 with flights from Guangzhou Baiyun International Airport (CAN) to Los Angeles International Airport (LAX).

Politics played a role here as, according to the Centre for Aviation (CAPA), the airline wanted to operate the aircraft out of Beijing Capital International Airport (PEK), rather than CAN because the former has more traffic potential. However, Air China, the country’s primary flag carrier, is also based at PEK, which was quite the quarrel to solve, especially on routes where the two would compete. Another problem was that China Southern’s A380s arrived in quick succession, with Airbus delivering four between October 2011 and September 2012, while the fifth arrived on February 28, 2013.

Cross-checking the date of CSA’s aircraft’s debut on an international leg to LAX with the delivery schedule, one can see that a lot of capacity was pumped into the Chinese domestic market until October 2012. But was that a problem?

For one, according to the carrier’s annual report, 79.8% of its capacity was on domestic routes, including Hong Kong, Macau, and Taiwan, with 74.3% of revenue coming from intra-China flights. International capacity measured at 20%, with 13.6% of total revenue from outbound-China routes. And the timing of the delivery of the A380 could not have been more perfect, even if the global economy was sluggish following the 2008 financial crisis. The Chinese economy, though, recovered quickly, as according to the OECD, the country “introduced the largest stimulus package in the world in late 2008, in the wake of the global financial crisis,” which resulted in the country’s economy being the first to recover following “a brief though sharp downturn in 2008,” the OECD continued.

“In 2012, international aviation markets continued to be sluggish under influence of the global economic situation. Benefitted from the steady growth of the China’s economy and the growing household consumption demand, the domestic civil aviation demand maintained a growth,” Si Xian Min, the former Chairman of the airline, said, describing the economic conditions in 2012. As such, the airline redeployed capacity to the domestic market to seize “the strategic opportunity of rapid development in China’s civil aviation,” Min added.

Ambitious approach to Airbus A380 operations

But the goal of the airline was not to use the superjumbo on routes from and to Chinese cities, as well as to Hong Kong or Macau. The ambition was to do much more, as developments in the airline’s network would go on to suggest.

“We put the flagship aircraft type such as A380 and B787 to the major international markets in Europe and the Atlantic Ocean, equipped them with the best service personnel, and enhanced the software and hardware strengths of our international routes,” China Southern Airlines (ZNH) said in its annual report from 2013. According to the report, the carrier was also the first airline in the world to simultaneously use the Airbus A380 and the Boeing 787.

However, the operation’s scale was problematic. As CAPA pointed out, if China Southern Airlines (ZNH) wanted to execute its initial plan to fly the A380 to several international cities, including the already mentioned city of Los Angeles, or cities within Europe, it would leave little room for error. A breakdown would bring its operations to a grinding halt. This had already happened in October 2011, when the carrier received the aircraft. Then, according to local media reports, a faulty flap power drive unit forced the carrier to scramble for spare parts, shipping them over from Germany in order to get the aircraft fixed in a matter of 24 hours.

Even if China Southern has one of the largest fleets in the world, the capacity of the Airbus A380 is still unmatched by any other aircraft bar the Boeing 747. The latter was only present in the airline’s fleet as a freighter. That means planning to operate a wide-reaching network with such a small fleet of double-deckers is no easy feat, as margins are tight, and a breakdown could have left China Southern Airlines (ZNH) scrambling for replacement aircraft that are by no means equal to the seats offered by the superjumbo.

Yet perhaps that was the reason for the A380s demise, especially once the COVID-19 pandemic hit and borders closed. Considering that China is still using some form of zero-COVID strategy, even if it has recently relaxed its rules, bringing the aircraft back to the airline’s operations made little sense. Especially since the type had a passenger load factor of 57.21%, per China Southern Airlines (ZNH) 2021 annual report, nowhere near enough to at least not lose money on each flight. The same report was also the nail in the coffin for the A380 bearing China Southern Airlines’ (ZNH) colors, as, by the end of 2022, the carrier did not plan to operate any of the aircraft.

The date was set, and the last-ever China Southern Airlines Airbus A380 flight departed from Los Angeles to Guangzhou (LAX to CAN) on November 6, 2022. It arrived in the Chinese city during hours of November 8, 2022. B-6319 was the registration of the Airbus A380 that took off for China Southern’s final flight with the type.

This flight marked the end of the relationship between the carrier and the aircraft. Two other A380s had exited the airline’s fleet in late 2021, while B-6138 and B-1640 were stored in October and November 2022, respectively. While other airlines are seemingly restoring their A380s in order to respond to the ever-growing travel demand, the situation has been different in China where demand continues to recovery very slowly post-pandemic.