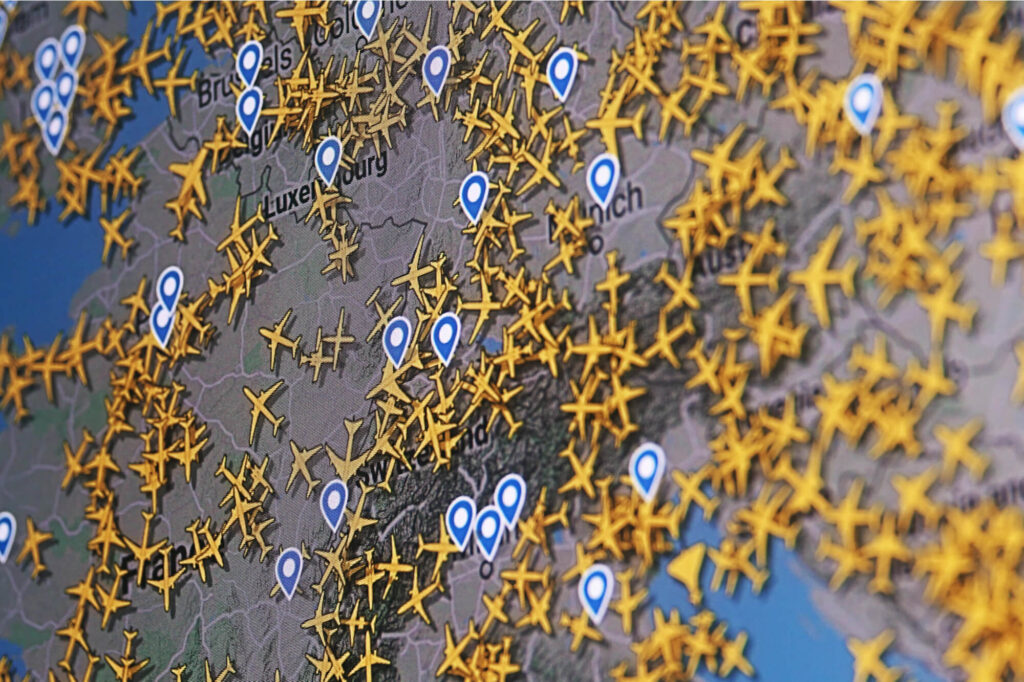

European air traffic may be suffering from the effects of the Omicron variant of the COVID-19 virus right now, but it is still set for further recovery in 2022, network manager Eurocontrol predicts.

Traffic, in terms of the number of flights, is set to recover to between 70-90% of pre-pandemic levels, Eurocontrol says in a paper published on January 1, 2022. In 2021, European traffic reached 56% of 2019 levels.

The paper also looked at the effects of the continuing COVID-19 pandemic on European traffic levels and airlines in 2021. The results from 2021 still show some way to go in terms of recovery, especially in terms of passenger numbers and airline financial losses.

In summer 2021, traffic hit 70% of pre-pandemic levels and improved to 81% in late October, during school vacations across the region. While the emergence of Omicron kept traffic to 75% of 2019 levels at the start of December, this improved to 81% in the second half of the month thanks to holiday period travel demand.

The situation is “enormously challenging” right now, Eurocontrol Director General Eamonn Brennan commented on the report. “Traffic may currently stand at 78% of 2019 levels, but the unfolding Omicron situation is pushing many of Europe’s top airlines to cut capacity in January by up to 30% – and in parallel, we are starting to see some flights canceled due to COVID-19 exposure among crew members.”

Still, Eurocontrol expects the “steady” recovery seen in 2021 to continue, with all its forecast scenarios predicting traffic returning to normal levels or close to normal levels in 2024/25.

“The emergence of the Omicron variant looks set, if not to reverse the gains of 2021, at least to stall growth for the time being, which means that actions taken at State level in 2022Q1 will be key to determining how traffic further evolves over the year.”

Which airline operated the most flights in 2021?

Source: Eurocontrol

No surprises here. Ryanair remained Europe’s top carrier in terms of number of flights for the seventh year in a row.

The low-cost carrier operated an average of 1,321 flights per day across the year, down 43% from 2019 levels. However, after a slow start to the year, it operated close to pre-pandemic levels over the summer peak period.

In what Eurocontrol described as “pandemic-defying performance”, Ryanair was the only carrier to operate at 2019 levels in December, while all other airlines were between 9-46% down. However, Ryanair has announced plans to slash capacity by one-third in January due to Omicron.

Which countries performed the best in 2021?

In terms of countries, southern Europe saw better recovery than northern Europe.

Britain was the worst hit in 2021, with 1.3 million fewer flights, equivalent to a 62% drop compared to 2019. Finland and Ireland also saw flights fall 62%. Germany was next with a 50% drop in flights, equivalent to the loss of 1 million flights, followed by Spain, France and Italy.

British airlines and airports have repeatedly said this year that the UK’s testing requirements and travel restrictions are holding back demand compared to their European rivals.

In Southern and eastern Europe, however, flights did not fall by as much. Bosnia-Herzegovina, Armenia, Ukraine and Greece all saw flights fall less than 30% compared to pre-pandemic levels. During August, flight levels in Greece even reached 94% of 2019 levels.

What about passenger numbers?

There may have been a recovery in flight numbers in 2021, but that doesn’t mean the planes were full or that airlines were making any money.

Load factors are at around 50-60% on average, and that will be hitting airline profits, Eurocontrol says. It says there were between 1.4-1.5 billion fewer passengers in 2021, compared with 2019. Airline financial losses stood at €18.5 billion for the year.

That is an improvement from 2020, however, when airline losses totalled €22.3 billion and 1.7 billion fewer passengers were carried.

Eurocontrol noted, though, that a wave of bankruptcies did not materialize, and the only casualty was Italian flag carrier Alitalia, which was replaced by ITA Airways. “However, the situation for Europe’s airlines remains highly challenging, especially for those carriers not receiving State aid.”

Any good news?

Cargo has been a bright spot throughout the pandemic, due to the need to move goods around the globe. Cargo traffic increased by 9.6% compared with 2019, representing a 6% share of the market. That’s double what it was pre-pandemic.

Business aviation was also up 3.5% on 2019 levels and its market share almost doubled to 12%. Eurocontrol says this is likely down to some business travelers switching to business aviation where scheduled routes were no longer available.

Overall for the aviation industry in Europe, Eurocontrol DG Brennan expects that when the pandemic stabilizes, the ensuing uptick in aviation will be swift.

“As soon as the situation improves, we expect to see a rapid rebound that will bring European aviation a lot closer to 2019 traffic levels. At the same time, this year all actors must urgently accelerate their plans to make aviation sustainable, building back sustainably with major investment in new technological solutions,” he said.